Väga huvitav (aga kahjuks pikk) blogipost seletamast COVID-19 mõju finantssüsteemile ja eurodollarile laiemalt, mille peal sisuliselt kogu maailma kaubandus käib hetkel, juurde trükkida saab aga ainult USA. Seletab muuhulgas päris hästi süsteemi geopoliitilisi mõjusi ja mis saab edasi, samuti miks USA antud hetkel üldse sellise defitsiidiga toimetab (kuna USA majanduse osakaal väheneb maailmas aga äri tehakse dollarites, aga USA on ainuke kes juurde trükib, ei olegi teist võimalust tegelikult).

On väga kaheldav et Hiina jt tahavad föderaalreservi päris maailmareserviks teha aga dollaripuudujääk on kolossaalne. Väga võimalik et näeme selle süsteemi ümbermängimist lähiajal.

Artikkel siin:

https://www.zerohedge.com/markets/down- ... ind-it-all

paar tsitaati:

However, at root the Eurodollar system is based on using the national currency of just one country, the US, as the global reserve currency.

This means the world is beholden to a currency that it cannot create as needed.

...

Indeed, look at the Eurodollar logically over the long term and there are only three ways such a system can ultimately resolve itself:

- The US walks away from the USD reserve currency burden, as Triffin said, or others lose faith in it to stand behind the deficits it needs to run to keep USD flowing appropriately;

- The US Federal Reserve takes over the global financial system little by little and/or in bursts; or

- The global financial system fragments as the US asserts primacy over parts of it, leaving the rest to make their own arrangements.

See the Eurodollar system like this, and it was always when and not if a systemic crisis occurs – which is why people prefer not focus on it all even when it matters so much. Yet arguably this underlying geopolitical dynamic is playing out during our present virus-prompted global financial instability.

How to read these data about where the Eurodollar stresses lie in Table 1? Firstly, in terms of scale, Eurodollar problems lie with China, the UK, Japan, Hong Kong, the Cayman Islands, Singapore, Canada, and South Korea, Germany and France. Total short-term USD demand in the economies listed is USD28 trillion – around 130% of USD GDP. The size of liabilities the Fed would potentially have to cover in China is enormous at over USD3.4 trillion - should that prove politically acceptable to either side.

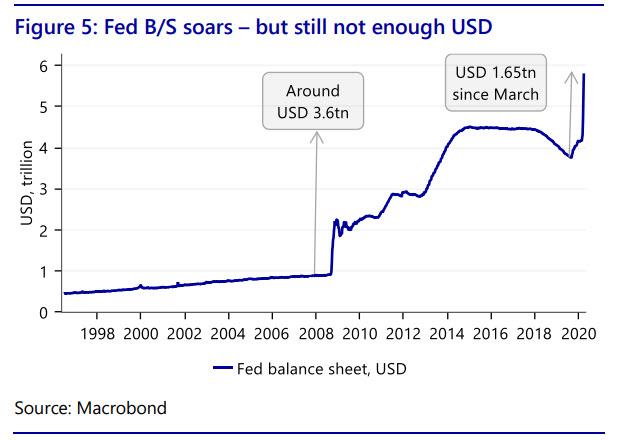

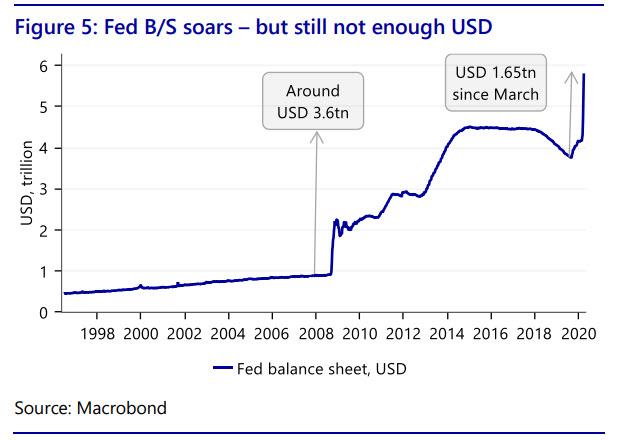

Essentially we have seen nearly five years of QE1-3 in five weeks! And yet it isn’t enough.

If the Fed is to step up to this challenge and expand its balance sheet even further/faster, then the US economy will massively expand its external deficit to mirror it.

That is already happening. What was a USD1 trillion fiscal deficit before COVID-19, to the dismay of some, has expanded to USD3.2 trillion via a virus-fighting package: and when tax revenues collapse, it will be far larger. Add a further USD600bn phase three stimulus, and talk of a USD2 trillion phase four infrastructure program to try to jumpstart growth rather than just fight virus fires, and potentially we are talking about a fiscal deficit in the range of 20-25% of GDP. As we argued recently, that is a peak-WW2 level as this is also a world war of sorts.